The wealth management landscape is changing faster than ever before. Evolving client demographics and behaviours are shifting sources of wealth and reshaping how clients expect to be served. Technology is enhancing the client experience, disrupting traditional delivery models, and reducing barriers to entry for new competitors. Growing regulatory requirements are placing pressure on incumbents and forcing firms to be disciplined in their risk and cost management practices.

In an increasingly disruptive environment, it is harder for established organizations to innovate and adapt quickly while also facing more scrutiny and a seemingly smaller margin for error. While there are certainly challenges to innovation, there are also many misconceptions that large banks are unable or unwilling to adapt.

Challenges of innovation

Agile and nimble are not readily synonymous with banks. In fact, some would argue the opposite. At their core, banks are built to protect, maintain and grow their business at a stable pace. Innovation can often run counter to this perception of stability and can be especially challenging in a highly-regulated industry like banking and wealth management.

Being innovative often means placing bets in areas that could be disruptive to the core of the business. Innovation also encourages experimentation and testing with new concepts that frequently fail, hiring non-traditional talent, and partnering with external firms and ecosystems rather than controlling from within – all characteristics that are not in the ‘DNA’ of large incumbent firms.

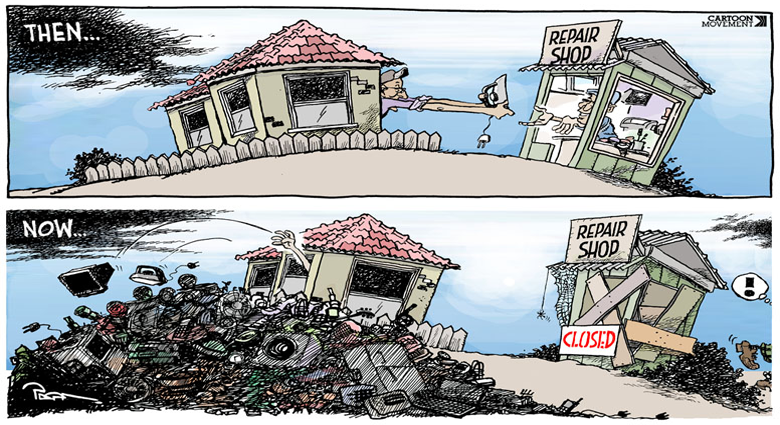

Confronting the structural and cultural challenges of innovation is imperative for many firms. There are countless examples of well-established industries and organizations failing to survive because of their inability to adapt or quickly respond to disruptive market innovations. Long-term success comes down to how an organization can change and be flexible to new ways of working, while leveraging its core strengths, and remaining ruthlessly client-centric.

How banks and wealth managers can approach innovation

To succeed in today’s environment, firms will have to pay close attention to evolving client needs – not only through traditional forms of market research but also by engaging end users directly and frequently in the development of new solutions. Clients expect personalized financial advice when, how, and where it is most convenient for them. In order to stay relevant, organizations need to place themselves in the context of their clients’ lives.

Large, diversified banks do have competitive advantages that innovation can help amplify, including access to deep client insights and data, extensive distribution reach and operational scale that allows for considerable investments in technology. Focusing on how these advantages can be strengthened through innovation will give banks a meaningful edge relative to competition.

Banks must break down barriers within their organization to create solutions that solve problems and deliver what is best for clients across businesses. Collaborating and partnering externally with financial technology firms, venture capitalists and other industry experts are also critical to better understand and anticipate market trends and opportunities to accelerate innovation.

RBC’s approach to innovation

RBC aims to create an environment that nurtures innovation and collaboration with a focus on putting the client first. At RBC Wealth Management, we are harnessing innovation to deliver exceptional experiences to our clients and advisors, simplify the business, and evolve the way we work.

Even in this digital world, high-net-worth clients continue to tell us they value their advisor as the cornerstone of their relationship and that personalized advice and planning is critical to meeting their complex needs. Our goal is to empower both our clients and advisors through market-leading digital solutions to provide choice and convenience, deliver rich and timely insights, enhance productivity and be relevant to future generations.

For example, we recently launched myGPS™, a web-based, integrated application that helps RBC’s North American wealth advisors provide interactive planning-oriented advice to their clients. Through new online and mobile solutions, we will enable our advisors and clients to interact more seamlessly with better access to digitized information.

We are also looking to evolve our culture and the way we work as an organization in order to deliver innovative solutions faster and better. We have launched agile labs within Wealth Management to develop new digital products and get them into our clients’ hands faster, while increasing engagement with the clients who will actually be using our products.

To jump start our innovation efforts, we are working closely with RBC’s innovation labs across North America that are dedicated to identifying, proving and applying new technologies, while partnering externally with fintechs and technology providers.

Ultimately, innovation is about the battle for relevancy in an ever-changing marketplace. We believe the next five to ten years will be a defining time period for wealth management – one that will separate winners and losers. Those who are committed to innovate and adapt will be well-positioned to win.

Amit Sahasrabudhe is the Head of Wealth Management Strategy and Digital Solutions at RBC Canada.

.png)

What Did You Think?